Headlines

Alleged N304.1m Fraud: More trouble for ex-NIMASA DG as court admits more evidence

Justice Tijani Ringim of the Federal High Court sitting in Ikoyi, Lagos, on Tuesday, March 14, 2023, admitted in evidence several documents tendered by the Economic and Financial Crimes Commission, (EFCC), against a former acting Director-General of the Nigerian Maritime Administration and Safety Agency, NIMASA, Haruna Baba Jauro, and two others.

Jauro alongside Dr. Dauda Bitrus Bawa and a company, Thlumbau Enterprises Limited, is being prosecuted on a 19-count charge bordering on stealing and money laundering to the tune of N304, 118, 500( Three Hundred and Four Million One Hundred and Eighteen Thousand Five Hundred Naira).

At the resumed sitting, the prosecution presented its third prosecution witness, PW3, Orji Chukwuma, an investigator with the Commission.

Led in evidence by the prosecution counsel, Rotimi Oyedepo, SAN, Chukwuma, of the Chairman Monitoring Unit, EFCC, Abuja, told the court that he was Head, of Special Task Force Unit 3, Lagos Zonal Command, at the time of the investigation of the alleged fraud.

When asked if he knew the defendants and the company, Thlumbau Enterprises Limited, the PW3, whose team was tasked with investigating money laundering and other financial crimes, stated that he came across all the defendants in the course of his investigation, upon receipt of intelligence reports against the management of NIMASA.

“Further investigation revealed that proceeds of unlawful activities of the 1st defendant, while he was the Executive Director of Finance and Administration in NIMASA, was concealed and laundered for his benefit through the 3rd defendant.

In his further testimony, Chukwuma told the court that funds co-mingled with loans taken from Aso Savings Limited to also acquire two other houses in Lagos.

He also stated that the names mentioned are children and relations of the 1st defendant and that their addresses are the same as his.

They were all admitted and marked as exhibits B, B1 and B2 by the court. During the proceedings, the prosecution counsel also asked the witness if there was an exchange of correspondence regarding the Aso Savings loans he earlier talked about, to which he answered in the affirmative, adding that it contained the mandate, statement of account, certificate of identification and mortgage correspondence of the first defendant.

While giving further testimony about exhibit A and some entries made on January 6,,2014, Chukwuma explained that there was an inflow of N15m ( Fifteen Million Naira) that came from the Committee of Intelligence belonging to NIMASA.

He said: “The Committee is set up and funded by NIMASA for specific purposes related to security.

“Investigations showed, from the account statement of January 23, 2014, that the sum of N12m (Twelve Million Naira) out of the N15m (Fifteen Million) was transferred to the account of the first defendant in Aso Savings to manage the loans he took to buy property.

“On July 10, 2014, another sum of N20m (Twenty Million Naira) was also paid into the account of the third defendant.

“Subsequently, the 2nd defendant also benefited the sum of N1, 470,000(One million Four Hundred and Seventy Thousand Naira), which was later returned to the Commission in a draft.”

When he was shown copies of the draft by the prosecution counsel, he identified them as the statement of one Ishaq Banabas, who returned the total sum of N35m (Thirty-five Million Naira) through five different bank drafts to the EFCC Draft Registration Form Receipt.

The drafts as well as the EFCC Draft Registration Form receipt were admitted in evidence and marked as exhibits D and D1, respectively.

The 3rd defendant’s account, according to him, was co-mingled and aggregated to the sum of N52m (Fifty-two Million Naira) paid to one Helen Mbonu, who used it to purchase a house for the first defendant.

Asked if the third defendant rendered any services that led to the various cash payments totaling N120m, the witness told the court that the 3rd defendant never rendered any services, adding that “the payments are proceeds of unlawful activities.”

Headlines

NIWA partners ICPC to strengthen internal transparency in its operations

Headlines

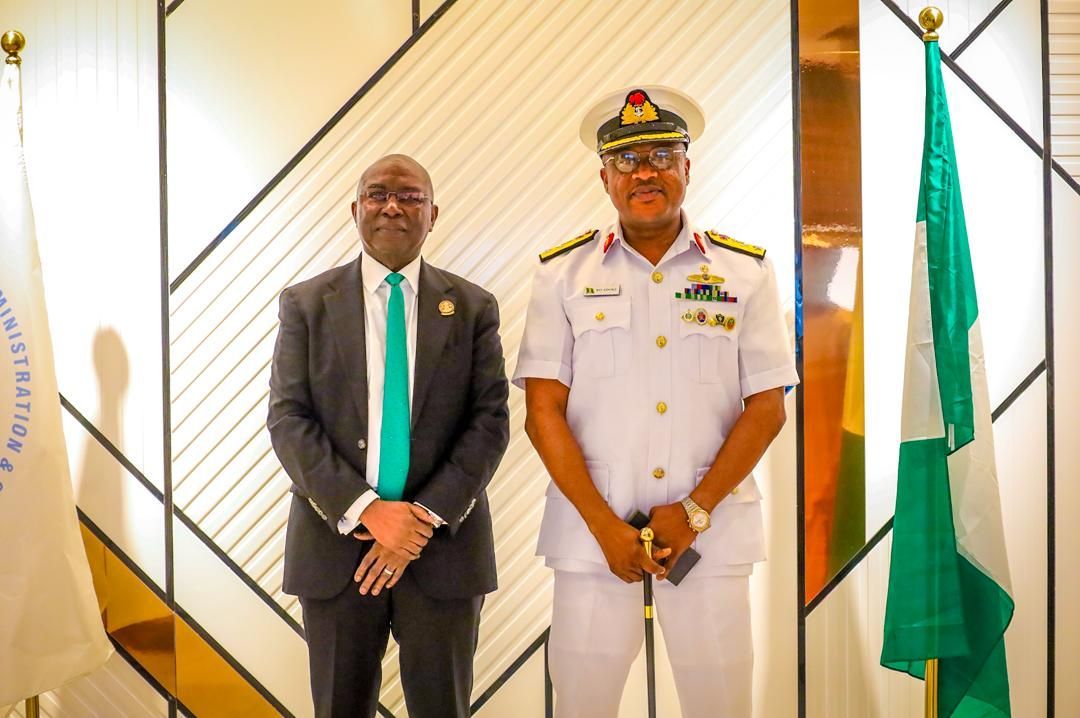

Navy appoints new Maritime Guard Commander for NIMASA

Commodore Adoki, a principal Warfare Officer specializing in communication and intelligence, brings onboard 25 years experience in the Nigerian Navy covering training, staff and operations.

Welcoming the new MGC Commander to the Agency, the Director General, Dr Dayo Mobereola, expressed confidence in Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA strengthen operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

Customs

Customs collects N1.585 trillion from 51 compliant traders under AEO programme

-

Headlines3 months ago

Headlines3 months agoEx-NIWA boss, Oyebamiji, emerges most media-friendly CEO in maritime industry

-

Headlines4 days ago

Headlines4 days agoFIFA sends Nigeria’s Super Eagles to 2026 World Cup, awards boardroom scoreline of 3 goals to nil against DR Congo

-

Headlines3 months ago

Headlines3 months agoMARAN pulls industry’s stakeholders to unveil its iconic book on Maritime industry.

-

Customs3 months ago

Customs3 months agoHow Comptroller Adenuga is raising revenue profile of Seme command, facilitating regional trade.

-

Headlines3 months ago

Headlines3 months agoNigeria showcases readiness for compliance with IMO decarbonization policy at Brazil conference

-

Headlines3 months ago

Headlines3 months agoOndo govt inaugurates former NIMASA Director, Olu Aladenusi, as Special Aide on Marine and Blue Economy