Economy

Don says CBN can print money to augment fall in revenue

Eyewitness reporter

A professor of Economics, Lanre Olaniyan, has declared that it was within the fiscal responsibilities of the Central Bank of Nigeria(CBN) to print money to augment Federal Government’s revenue.

Olaniyan said on Tuesday that there was nothing unusual about this phenomenon whenever the need arises.

He was reacting to an allegation made by Gov. Godwin Obaseki of Edo State that the CBN printed money to augment the shortfall of March revenue allocations to states.

However , Prof. Olaniyan, who teaches at the University of Ibadan, said the concept of ‘printing money’ does not always relate to the printing of physical cash.

“This happens virtually all over the world. The money is not always printed as cash.

“Sometimes, it just refers to ‘creation of money’ for the government.

“Cash is only involved when and if the cash reserve is very low.

“But the big issue is that any money that is printed to support the government is a loan.

“It is not a free gift. It appears in the balance sheet as loans given to the government,’’ he said.

The idea, he added, was for the Central Bank to give loans to the government as ‘the lender of last resort’.

“I do not know for sure whether or not the CBN printed money, but there is nothing wrong if it did.

“It is the duty of the CBN to print money, and virtually, every Central Bank in the world prints money.

“Apart from the reason of shortage of cash or replacing mutilated cash in circulation, the CBN can print money to give loan to the government.

“In elementary economics, we are told that the Central Bank is the lender of last resort to the government,’’ he said.

According to the professor, when governments face revenue challenges, they usually resort to their Central Banks for succour.

The Central Banks, he said, would usually raise such monies through the sale of bonds and treasury bills.

He, however, added that the idea of printing money should be under certain economic considerations.

“When the CBN gets such money, either through bonds or treasury bills, it then gives it to the government as a loan with terms.

“It could be a short term of between one month and 90 days, or long term of between one year and five years.

“When government prints money, it is usually to stimulate a productive sector of the economy for increased economic growth and sustainability,’’ he said.

Olaniyan added that high-interest rates usually served as incentives for people to invest in bonds or treasury bills.

“In the last one year, because of the recession that we had, the interest rate has gone low, and people are not too willing to invest in treasury bills or bonds,’’ he said.

According to him, Nigeria has limited choices in sourcing for improved revenue as most revenue sources are getting tight.

“The other alternative is foreign loans, but we already have a high burden of foreign loans.

“The total revenue of the government is about the same amount we are spending on debt servicing,’’ he said.

The Finance Minister also addressed the issue of external debt last Wednesday.

“The Nigerian debt is still within a sustainable limit.

“Our debt, currently at about 23 percent to GDP, is at a very sustainable level if you look at all the reports that you see from multilateral institutions,’’ she had said.

Olaniyan said also that “the only option is to go back to elementary economics and approach the ‘lender of last resort’, the CBN.

“If people are not investing in treasury bills and bonds, the Central Bank embarks on printing of money.

“It is called, ‘Seigniorage’, a process where the apex bank prints money to fund activities of government.’’

The Don said that Nigeria was a country freshly out of recession, which needed to put money in people’s pockets to sustain the post-recession economy.

“The Federal Government will have to spend enough money that will go round a large percentage of the citizenry; it is called ‘Quantitative Easing’.’’

Nevertheless, Zainab Ahmed, Minister of Finance, Budget, and National Planning, has debunked Obaseki’s claim.

“It is not true to say we printed money to distribute at FAAC. It is not true,’’ the minister said last Wednesday at the end of the weekly Federal Executive Council meeting.

Continue Reading

Business

National Single Window goes live in March, 2026

– as FG launches phase 1 of the project for trade facilitation

Funso OLOJO

The Federal Government of Nigeria has announced the commencement of Phase 1 of the National Single Window (NSW) Project, scheduled to launch on March 27, 2026.

The launch marks a decisive step toward reforming Nigeria’s trade ecosystem through technology, transparency, and smarter regulation.

The National Single Window is a centralised digital platform designed to simplify and harmonise trade procedures by enabling traders to submit trade-related information once,

through a single interface, while relevant government agencies access, process, and approve the required documentation seamlessly.

The initiative is expected to significantly reduce delays, eliminate duplication, curb inefficiencies, and lower the cost of doing business at Nigeria’s ports and borders.

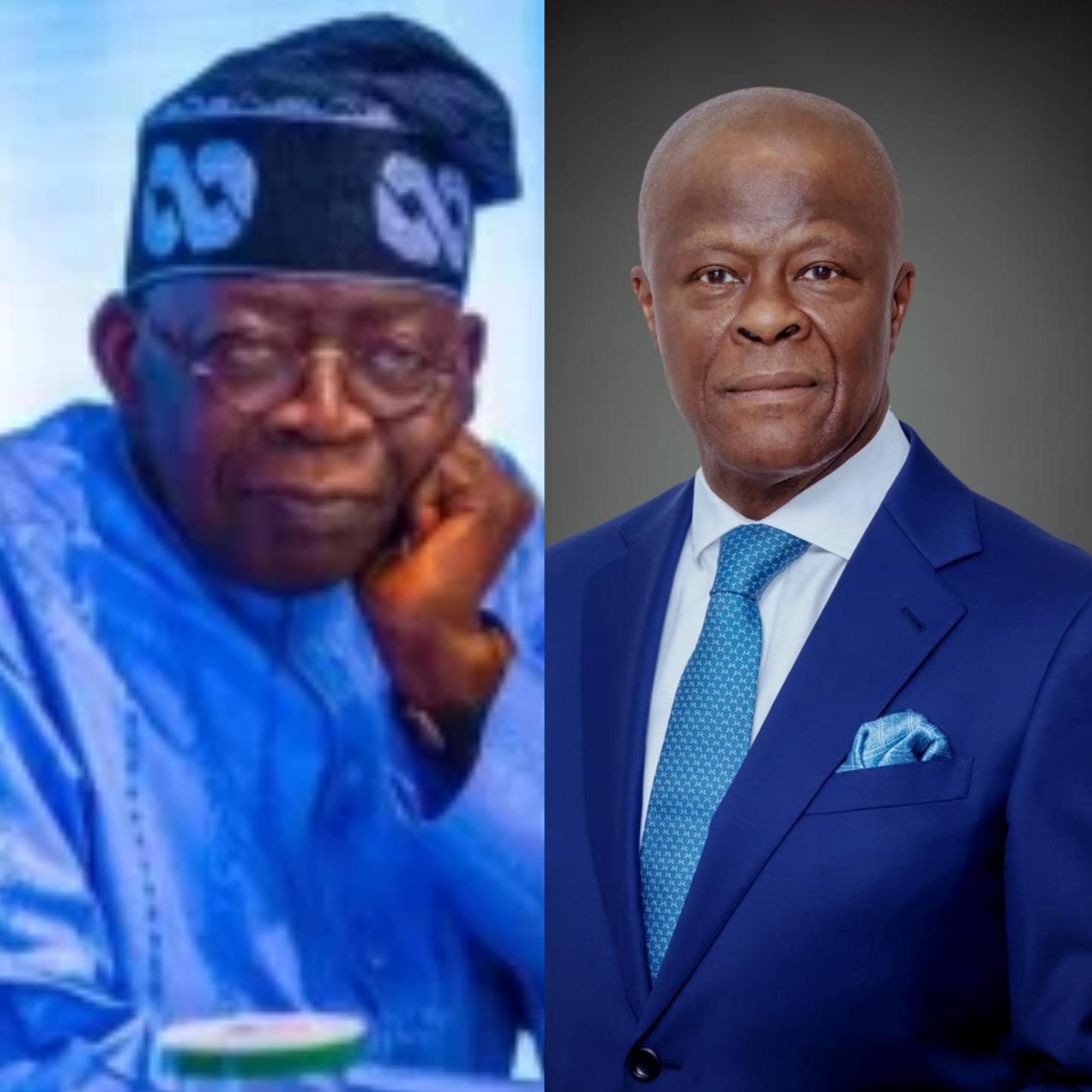

Speaking on the transformative potential of the project during the inauguration of the project on the 16th of April 2024, President Bola Ahmed Tinubu described the National Single Window as a cornerstone of Nigeria’s trade and economic reform agenda.

“The National Single Window will change the way trade is done in Nigeria. It will replace fragmentation with coordination, opacity with transparency, and delay with efficiency,” says Presidency.

The President added that the NSW aligns with the administration’s commitment to

economic diversification, non-oil export growth, and improved ease of doing business, noting that efficient trade systems are critical to national development.

Also speaking on the initiative, the Minister of Industry, Trade and Investment, Dr. Jumoke Oduwole, described the National Single Window as a game-changer that will simplify and

democratize trade in Nigeria.

Dr. Oduwole explained that the platform will streamline trade documentation through a unified window, enabling greater transparency, improved transaction tracking, and

increased trade volumes.

She added that experienced traders, in particular, would benefit from the efficiency gains offered by the system.

Providing insight into the implementation strategy, Mr. Tola Fakolade, Director of National Single Window Project, explained that the Federal Government has deliberately adopted a phased rollout approach, beginning with Phase 1, which will focus primarily on statutory permits and manifests.

“The National Single Window will be rolled out in phases, starting with Phase 1, which concentrates on statutory permits and cargo manifests,” Mr. Fakolade stated.

“This allows us to stabilise the system, build confidence among stakeholders, and deliver immediate value where bottlenecks are most pronounced.”

According to Mr. Fakolade, the decision to phase the launch reflects lessons learned from previous large-scale technology initiatives that adopted a “big bang” approach.

“We have learned from the flaws of past big bang technological rollouts, where attempting to do everything at once created avoidable disruptions,” he noted.

“Phasing the National

Single Window is a deliberate and strategic choice—one that prioritises sustainability, user adoption, and continuous improvement over speed for speed’s sake.”

He further emphasized that subsequent phases will gradually expand the scope of the platform, onboard additional agencies, and deepen integration across the trade value chain, ensuring a resilient and scalable system.

“This approach ensures that the National Single Window grows with the ecosystem, guided by real data, user feedback, and operational realities,” Mr. Fakolade added.

As Phase 1 goes live, the Federal Government reaffirmed its commitment to working closely with the private sector, development partners, and trade stakeholders to ensure a smooth

transition and shared ownership of the reform.

“By simplifying trade processes and leveraging digital innovation, we are unlocking faster movement of goods, strengthening revenue assurance, and creating a more competitive

environment for Nigerian businesses to thrive locally and globally.” Mr. Fakolade added.

With the launch of the National Single Window, Nigeria takes a bold and pragmatic step towards modern trade governance—one that places efficiency, transparency, and learning at the heart of national progress.

Economy

We haven’t stopped Customs, FIRS, NUPRC, others from deducting cost of revenue collection at source – FG

Funso OLOJO

The Federal government has debunked the widely- held insinuation that it has stopped the standard practice of revenue – generating agencies such as the Federal Inland Revenue Service (FIRS), the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), and the Nigeria Customs Service (NCS) to deduct their cost of collection at source.

In a statement issued by the Federal Ministry of Finance and signed by Mohammed Manga, Director of Information and Public Relations in the ministry, at no point did the Minister of Finance and the Coordinating Minister of Economy, Wale Edun, announced the discontinuation of such practice.

“We categorically state that these reports are inaccurate and misleading.

“At no point during his remarks at the Nigeria Development Update (NDU) programme hosted by the World Bank did the Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, announce or imply any change to the existing policy on the cost of collection deductions.

“For the avoidance of doubt, there has been no policy change regarding the deduction of costs of collection at source by revenue-generating agencies. The current framework remains in effect.

“What is underway are ongoing policy discussions in line with the directives of His Excellency, President Bola Ahmed Tinubu, to review cost of collection structure.

“These discussions are part of broader efforts to enhance transparency, efficiency, and value-for-money in public financial management.

“However, no final decision has been made on this matter.

“The Ministry assures all stakeholders and the public that revenue operations continue uninterrupted and that any future adjustments will be guided by due process, stakeholder engagement, and clear communication.

“We urge media organisations to seek clarification from official sources before publishing information that may cause unnecessary confusion.

“The Ministry appreciates the continued support of Nigerians as we work collectively to build a stronger, more transparent, and sustainable economy” the statement concluded

Economy

Le Look Nigeria marks 40 years of ingenious local fabric branded bags on October 1st

Gloria Odion

All is set to mark the 40 years anniversary of Le Look Nigeria Limited, makers of Le look Bags brands.

According to the founder and Chief Executive Officer(CEO), Chief Mrs. Chinwe Ezenwa, arrangements have been concluded to hold the event on October 1, 2025 at Federal Palace Hotel, Lagos.

The event with morning and award night sessions is themed: “Legacy of Resilience: Empowering Entrepreneurs for Africa’s Economic Future.”

Ezenwa added:”Le Look 40th Anniversary is a milestone that celebrates resilience, creativity, and the power of Nigerian enterprise.

“Founded in 1985, Le Look has grown from a small women-led business into a proudly Nigerian manufacturer, exporting unique, locally crafted bags to international markets.

“Over four decades, we have stayed true to our mission of:

Strengthening local manufacturing;

creating jobs and transferring skills;

opening doors for women and youth in enterprise;

supporting Nigeria’s non-oil export drive and the AfCFTA agenda.

“This anniversary is more than a celebration—it is a call to sustain entrepreneurship in Africa’s fast-changing economy,” she noted.

With expected over 300 distinguished guests, including senior government officials, private sector leaders, development partners, and entrepreneurs across generations;

the day will feature keynote address and fireside conversations with veteran entrepreneurs as well as panel sessions on business longevity.

Other features are African Continental Free Trade Agreement(AfCFTA) readiness;

Youth and women forums on inclusive business practices

Exhibitions by government and trade agencies will be part of the activities.

Le Look Nigeria Limited has grown to a global brand with the Le Look Bags Academy built in Abuja, Enugu and Lagos.

Le Look is a manufacturer of afro-centric luxury-life style branded bags inspired by African culture and sensibility.

These handbags are crafted from African prints in celebration of the rich African heritage with international and modern fashion flair.

The company offers multiple product categories, including ready-to-wear, handbags, Apple-support products and other carry-on unique and durable accessories.

“Our partnership with designers in Africa has catalysed the resurgence of retailing locally made goods across the continent,” Ezenwa said.

According to her, “Through our studio in Lagos, we provide on- the-job training, school tuition and health care benefits.

“Our philosophy is simple-to be the first and foremost African luxury brand with global reach”, she added.

Over the years, Le Look Bags Academy has partnered international and government institutions to promote trade and build capacities for the continent.

The Nigerian Export Promotion Council (NEPC) last year partnered Le Look Nigeria Limited to boost Nigeria’s non-oil exports and empower local artisans, particularly women and youth in Lagos. This collaboration, includes the launch of an export skills acquisition center and a fashion innovation hub to equip individuals with skills in bag-making and international trade to meet growing global demand for handcrafted bags.

Also, UNDP Nigeria is in partnership with Le Look Bags Academy, to launch a training program designed to equip unemployed youth with limited formal education, primarily women, with practical skills in bag-making as a sustainable livelihood mechanism.

Le Look Bags Academy serves as the leading hub for mastering bag-making and digital technology skills.

The academy provides a unique, personalized approach to equipping learners with the necessary skills to succeed in the dynamic global landscape.

Le Look Nigeria Limited is the first Small and Medium Enterprise (SME) to receive the Authorized Economic Operator (AEO) certificate from the Nigeria Customs Service (NCS).

As a certified AEO, Lelook benefits from trade facilitation, reduced costs, and improved efficiency in its export and import activities, supporting Nigeria’s goal of becoming a leading trade hub.

Le Look Nigeria is No 0001 under the AFCFTA guided trade Initiative to receive the Certificate of Origin to trade across Africa

-

Headlines3 months ago

Headlines3 months agoEx-NIWA boss, Oyebamiji, emerges most media-friendly CEO in maritime industry

-

Headlines4 days ago

Headlines4 days agoFIFA sends Nigeria’s Super Eagles to 2026 World Cup, awards boardroom scoreline of 3 goals to nil against DR Congo

-

Headlines3 months ago

Headlines3 months agoMARAN pulls industry’s stakeholders to unveil its iconic book on Maritime industry.

-

Customs3 months ago

Customs3 months agoHow Comptroller Adenuga is raising revenue profile of Seme command, facilitating regional trade.

-

Headlines3 months ago

Headlines3 months agoNigeria showcases readiness for compliance with IMO decarbonization policy at Brazil conference

-

Headlines3 months ago

Headlines3 months agoOndo govt inaugurates former NIMASA Director, Olu Aladenusi, as Special Aide on Marine and Blue Economy