Headlines

News Alert: Court freezes jailed ex-bank PHB MD, Atuche’s N19.1b stashed in 24 banks

Justice Lateefat Okunnu of the Lagos State High Court sitting in Ikeja has ordered the freezing of the assets and funds to the tune of N19, 178, 253,050 belonging to a convicted former Managing Director of the defunct Bank PHB Plc, Francis Atuche.

The Judge gave the order on Tuesday, August 31, 2021, following an ex parte application filed by the Economic and Financial Crimes Commission, EFCC, on August 17, 2021.

The funds, investigation showed, were domiciled in 24 different banks in Nigeria, including Citi Bank Limited; Ecobank Nigeria Limited; First Bank of Nigeria Plc; First City Monument Bank (FCMB); Globus Bank Limited; Fidelity Bank Plc; Keystone Bank Limited; Lotus Bank Limited and Mainstreet Bank Plc.

Others are: Polaris Bank Plc; Platinum Mortgage Bank Limited; Providus Bank Limited; Stanbic IBTC Nigeria Limited; Standard Chartered Bank; Sterling Bank Plc; Wema Bank Plc; Zenith Bank Plc; Unity Bank Plc; Titan Trust Bank Limited, Union Bank of Nigeria Plc and others.

Moving the application, counsel to the EFCC, Kemi Pinheiro, SAN, told the court that 15 persons, as well as 22 firms, were used by Atuche and his co-respondent, Ugo Anyanwu, a former Chief Financial Officer of the bank, to launder the funds.

Pinheiro listed the individuals to include Anthony Atuche, Emeka Patrick Atuche, Paul Okobi, Felix Oyiana, Moruf Kazeem Adisa, Olatunji Abiodun, Daniel Enebeli, Aina Olugbenga, Augustine Nwabueze, Omonua Benedict, Oliver King Nduaaron, Dr. Chris Ike Ogbechie, Mr. Murat Bektaslar, Attah Omataikpo Olukemi and Thomas Etuh.

The EFCC counsel further stated that the firms, in which Atuche has either direct or indirect interest are: Aqua Harvest Limited, Hubmart Stores Limited, Hubmart Limited, Sapphire Capital Management Limited, Homeland Real Estate Company Limited, Malechi Foods Limited, Homeland Meridian Partners Limited, Promise Investment Limited and Temple Cottage Hotel Limited.

Others are: Wegas Properties Project Limited, Buckhead Construction Limited, Claremount Management Services Limited, Afco Associates Limited, Platinum Capital Limited, Ghazali Yakubu Investment Limited, The Financial (Services) Company Limited, Venture Resources Limited, Elizabeth-A Company Limited, Signature Partners Limited, Purplepay Technologies Limited, Oakwood Asset Management Limited and Conesto Nigeria Limited

Justice Okunnu granted the 12 prayers of the applicant and held that “An order is made restraining the 1st defendant (Atuche) whether by himself or acting through the persons or entities listed or such other persons including but not limited to his family members or agents, from removing, alienating, disposing of, dealing with or diminishing the value of assets, proceeds of economic and financial crimes or otherwise in the name of the 1st defendant.”

The Judge also held that “the assets or funds included those held indirectly by or for Atuche’s benefit, whether solely or jointly held, that are located in Nigeria or worldwide.”

Justice Okunnu further ordered the freezing of any bank account being run and operated by Atuche “personally or jointly, whether in his personal name or otherwise or with the Bank Verification Number (BVN) 22295357230 in any of the respondent banks to the tune of N19, 178, 253, 050 billion, pursuant to the Restitution Order made by this Honourable Court on June 16, 2021.”

Atuche and his privies, including his lawyers, were also barred from presenting to the above-listed banks “any mandate or instruction for the withdrawal of any money and/or funds standing to the credit of any of their accounts to the tune of N19, 178, 253. 050 billion.”

Justice Okunnu, who also restrained the banks from honouring any such instruction from Atuche and his privies, further held that “ A mandatory order of injunction is made directing the named respondent banks to file within 48 hours of service of this Order of this Honourable Court on their returns of the Statements of Account of the 1st Defendant (personally or jointly) whether in his personal name or otherwise or with the Bank Verification Number: 22295357230 and the accounts of persons and entities listed in the aforementioned Schedules A and B maintained with them.

“A further order is made directing service of the Order made herein on persons affected thereby including, in particular, the persons and entities listed in Schedules A and B. by way of advertisement in either The Punch or Thisday or The Guardian newspaper.”

Justice Okunnu had, in June this year, sentenced Atuche to six years imprisonment and Anyanwu four years for stealing and conspiracy to steal to the tune of N25.7bn.

The judge, while sentencing the duo, had ordered them to make restitution of the sum of N25.7bn to the Federal Government to replace the funds stolen from the public to bail out the bank.

Headlines

NIWA partners ICPC to strengthen internal transparency in its operations

Headlines

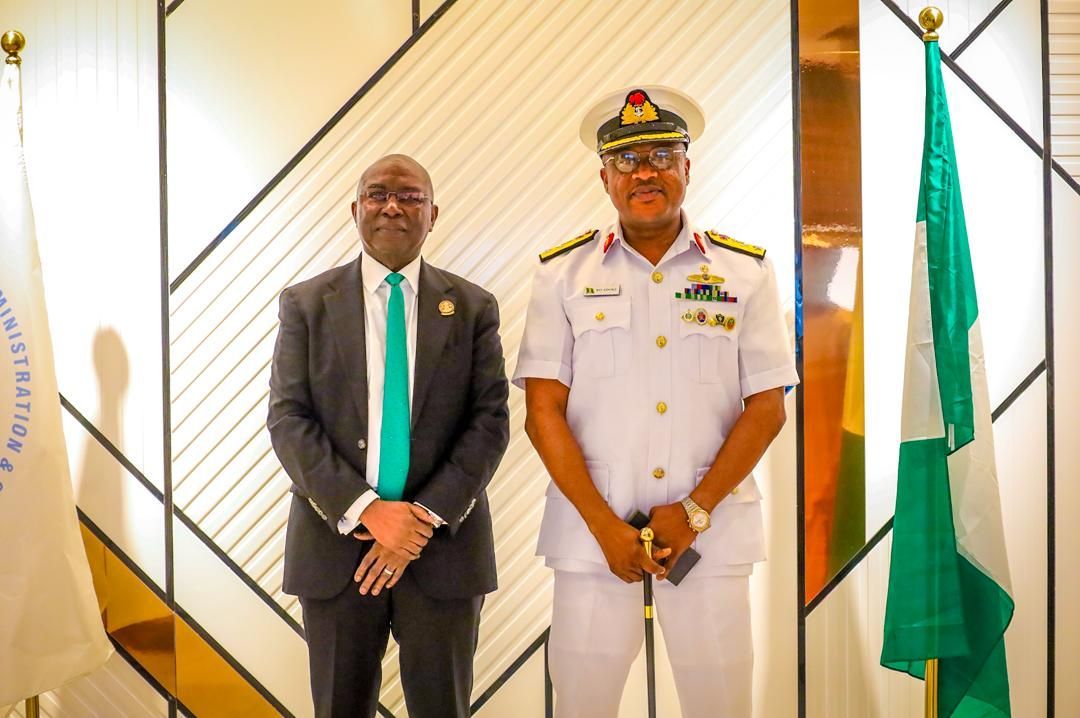

Navy appoints new Maritime Guard Commander for NIMASA

Commodore Adoki, a principal Warfare Officer specializing in communication and intelligence, brings onboard 25 years experience in the Nigerian Navy covering training, staff and operations.

Welcoming the new MGC Commander to the Agency, the Director General, Dr Dayo Mobereola, expressed confidence in Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA strengthen operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

Customs

Customs collects N1.585 trillion from 51 compliant traders under AEO programme

-

Headlines3 months ago

Headlines3 months agoEx-NIWA boss, Oyebamiji, emerges most media-friendly CEO in maritime industry

-

Headlines4 days ago

Headlines4 days agoFIFA sends Nigeria’s Super Eagles to 2026 World Cup, awards boardroom scoreline of 3 goals to nil against DR Congo

-

Headlines3 months ago

Headlines3 months agoMARAN pulls industry’s stakeholders to unveil its iconic book on Maritime industry.

-

Customs3 months ago

Customs3 months agoHow Comptroller Adenuga is raising revenue profile of Seme command, facilitating regional trade.

-

Headlines3 months ago

Headlines3 months agoNigeria showcases readiness for compliance with IMO decarbonization policy at Brazil conference

-

Headlines3 months ago

Headlines3 months agoOndo govt inaugurates former NIMASA Director, Olu Aladenusi, as Special Aide on Marine and Blue Economy