–– as beneficiaries have eight years tenor to pay back with interests

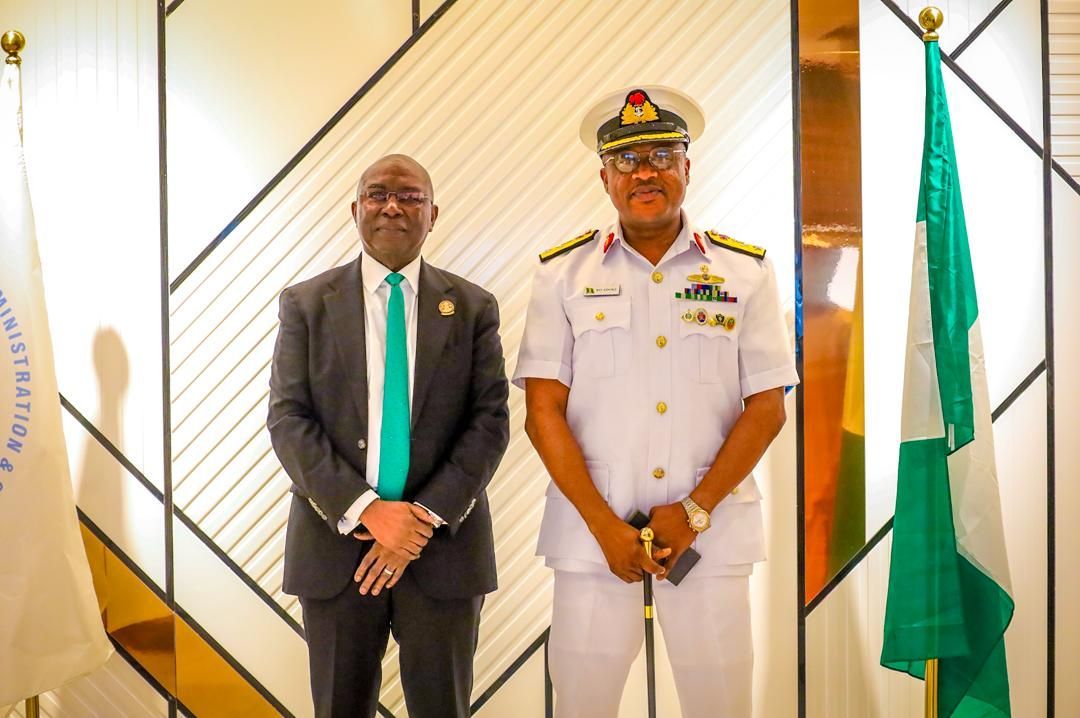

Funso OLOJO

But for the determination and insistence of the Nigerian Maritime Administration and Safety Agency (NIMASA), to ensure that the Cabotage Vessels Financing Funds (CVFF) loan is given to beneficiaries at a single digit interest rate, the 12 Primary Lending Institutions (PLIs) are not ready to disburse the loan below 10 percent rate.

As a matter of fact, all the 12 PLIs insisted on giving out their own 35 percent equity shares at an interest rate above single digit.

That was their insistence after several months of negotiations with NIMASA.

Mr Yusuf Buhari, the financial consultant to the CVFF, said as much when he declared that the cost of 35 percent equity contribution of the PLIs was above single digit interest rate.

At the one- day stakeholders interactive forum on operationalization of CVFF, held in Lagos on Monday, May 12th,2025, Buhari said there was no way the PLIs would have lent their 35 percent equity below the cost of the fund.

“We would not expect them(PLIs) to lend below their cost of fund.

” The 35 percent equity of the PLIs will be above single digit based on their risk assessment” the financial consultant declared.

However, determined to break the jinx which has over the year bedevilled the disbursement of the CVFF and the desire not to give the loan out above single digit interest rate, the present leadership of NIMASA, with the permission of the Minister of Marine and Blue Economy, Adegboyega Oyetola, agreed to serve as a buffer for the beneficiaries by agreeing to dilute the higher interest rates insisted on by the PLIs with its own 50 per cent equity contribution and lower the rate to below 10 percent.

Buhari attested to NIMASA’s sacrifice

” However, what is the diluting factor here is the 50 percent equity share that comes from NIMASA.

” That is strategic. When you add the cost of funding from the PLIs and the cost of funding from NIMASA, we expect that it would not exceed the single digit interest rate.

“This negotiation, calculation will be done before approval letter is issued to the beneficiaries of the loans”

” We would ensure that it will be part of the responsibility of NIMASA to ensure that whatever interest rate your bank is giving you, when diluted by NIMASA’s 50 percent contribution, will be an agreeable rate that will not exceed the single digit interest rate.

” The single digit weighted rate is our target” Buhari declared.

Sources whispered to our reporter that the present management of NIMASA had to bend backward to accept the tough conditions of the bankers as it didn’t want the negotiation to get stalled once again.

It could be recalled that it was at this stage of fixing the interest rate with the initial five PLIs hitherto engaged by NIMASA that the negotiation broke down during the tenure of the estwhile NIMASA DG, Dr Bashir Jamoh.

During that period, the PLIs insisted that they could not offer their own 35 percent equity contribution at single digit interest rate, a position the former NIMASA management opposed, insisting on less that 10 percent interest rate.

” The negotiation later broke down when the two parties maintained their hardline positions.

It was this same hardline position the 12 PLIs brought to the table when negotiations resumed on disbursement process with the present management of NIMASA led by Dr Dayo Mobereola.

Sources further claimed the expansion of the PLIs numbers from initial five to 12 was meant to break their resolve to charge above single digit .

Unfortunately, this strategy did not work as the bankers insisted they could not offer interest rate below the cost of funds they are contributing.

Determined to disburse the funds after several years of delays, the incumbent leadership of NIMASA had to abandon the hardline posture of its predecessor and agreed to the terms and conditions of the PLIs while deciding to use its 50 percent equity contribution as a buffer to dilute the higher interest rates charged by the PLIs.

Meanwhile, Mr Buhari, the financial consultant to the Funds, revealed that each of the successful bidders for the Funds is at liberty to approach any of the 12 approved PLIs to negotiate for a favourable rate that would be brought to NIMASA which will dilute whatever the rate it is to below 10 percent.

By implication, it is obvious that the 12 PLIs will charge different interest rates, which is above 10 percent,while the beneficiaries will get the rate from the PLIs according to his bargaining power.

But what is constant, according to Buhari, is that no matter the rate each of the beneficiaries get from their banks, the loan will be given to them at below 10 percent interest rate, thanks to NIMASA.

“The beneficiaries could use any bank among the 12 PLIs, the one that offers best terms and conditions.

” Negotiate your rate of 35 percent with the banks.

” Whatever rate you get from your bank will be diluted by NIMASA to bring it down to a single digit interest rate.

” The interest rate will be worked out on case to case basis.

” The PLIs will give different rate which would be dependent on their risk assessment but NIMASA will dilute it to less than 10 percent interest rate” Buhari maintained.

In addition, Buhari disclosed that eight years tenor period is given by the banks for the beneficiaries to pay back the loan.

The eight years tenor is the cap period as this could be less, according to the terms and conditions of the banks.

Again, this presupposes that the bargaining power of each of the beneficiaries of the loan will come to play when negotiating for a favourable tenor which will not exceed eight years.

Those with weak bargaining power may get shorter tenor for loan repayment.

Headlines3 months ago

Headlines3 months ago

Headlines4 days ago

Headlines4 days ago

Headlines3 months ago

Headlines3 months ago

Customs3 months ago

Customs3 months ago

Headlines3 months ago

Headlines3 months ago

Headlines3 months ago

Headlines3 months ago