Headlines

More vessels continue to boycott Red Sea as Houthi intensifies attacks

The Eyewitness Reporter with agency reports

“The U.S. and U.K. airstrikes on Houthi positions in Yemen have not made the Red Sea any safer for shipping. “Red Sea issues are getting worse, not better,” said Stifel shipping analyst Ben Nolan.

The dry bulk carrier Gibraltar Eagle, owned by Connecticut-based Eagle Bulk (NYSE: EGLE), was struck by an anti-ship ballistic missile in the Gulf of Aden on Monday.

Energy shipper Shell (NYSE: SHEL) halted all Red Sea transits on Tuesday, as did the big three Japanese tanker and bulker owners: MOL, NYK and K-Line.

Container-ship diversions around the Cape of Good Hope now appear likely to last for months.

The Red Sea effect on tanker trades remains uncertain, although a tipping point may be very near.

“There has already been a sharp decline in container ships approaching the Gulf of Aden, which feeds into the narrow Bab-el-Mandeb Strait, and there are likely to be major declines across other shipping segments as well in the coming weeks,” predicted Omar Nokta, shipping analyst of Jefferies, in a client note on Tuesday.

Ship-position data shows container transits down precipitously, tanker transits down modestly, and dry bulk transits down very little if at all.

Container-ship arrivals in the Gulf of Aden were at their lowest level on record last week, down 90% from the 2023 average, according to Clarksons Securities.

In contrast, bulk carrier arrivals in the Gulf of Aden were in line with the historical average, and tanker arrivals were down 20% versus 2022-2023 levels, according to Nokta, who cited Clarksons data.

According to data from commodity analytics group Kpler, the moving average of tanker transits of the Suez Canal had fallen to 14 per day this week, the lowest level since May 2022 and down from an average of 22 per day a month ago.

In other words, there are detours on the tanker side, which are positive for rates, but still nothing close to what’s being seen in container shipping.

“So far, most tanker owners remain unwilling to commit to a costly rerouting around the African Cape,” said ship brokerage BRS on Monday.

“Since the events of Friday [the beginning of coalition strikes in Yemen], shipping data implies that only a handful of tankers heading from east to west have definitely changed course away from the Red Sea.

“Accordingly, there remains the potential that widespread rerouting could occur over the coming days.

“War risk insurance premiums for ships have skyrocketed,” Mørkedal wrote in a client note on Monday, prior to the attacks on the Gibraltar Eagle and Zografia.

“In the past few weeks, premiums have increased from 0.1% normally to 0.5% of a ship’s hull value.

Mørkedal cited the example of a 10-year-old LR2 (Long Range 2) product tanker valued at $60 million.

In comparison, the extra fuel cost of taking an LR2 around the Cape at 12 knots would be $250,000.

Richard Meade, editor in chief of Lloyd’s List, a publication that covers both shipping and insurance, wrote late Tuesday that Red Sea premiums have now risen to 1% of hull value, that a “tipping point has been reached,” and that further diversions of tankers and bulkers should be announced within the next 24 hours.

Headlines

NIWA partners ICPC to strengthen internal transparency in its operations

Headlines

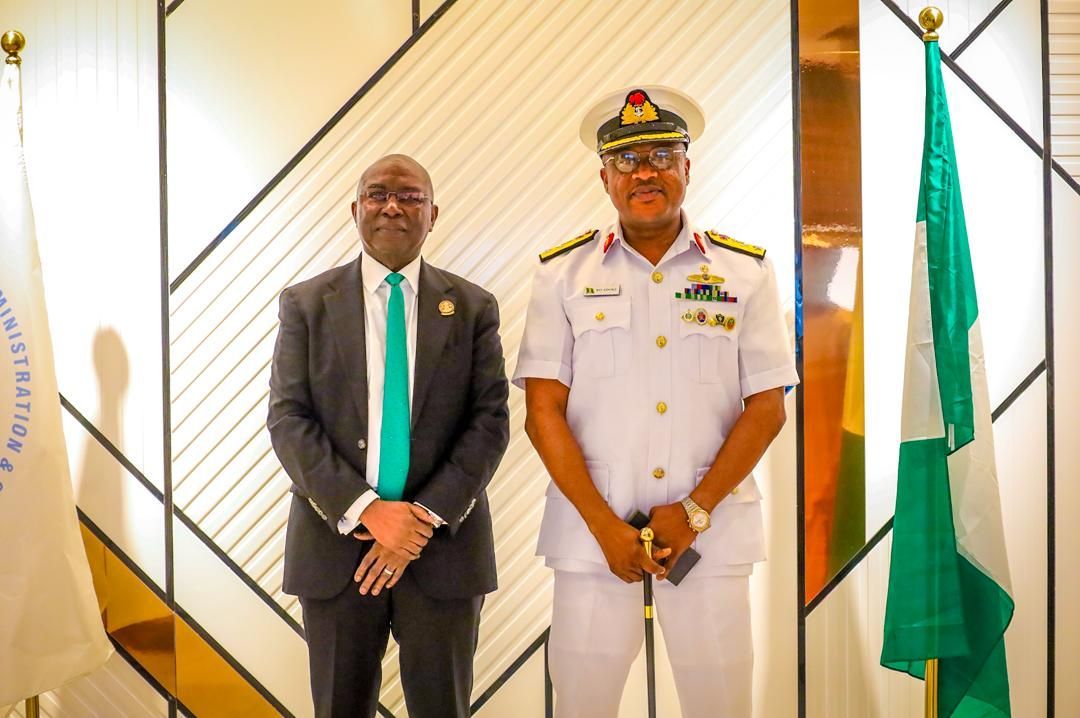

Navy appoints new Maritime Guard Commander for NIMASA

Commodore Adoki, a principal Warfare Officer specializing in communication and intelligence, brings onboard 25 years experience in the Nigerian Navy covering training, staff and operations.

Welcoming the new MGC Commander to the Agency, the Director General, Dr Dayo Mobereola, expressed confidence in Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA strengthen operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

Customs

Customs collects N1.585 trillion from 51 compliant traders under AEO programme

-

Headlines3 months ago

Headlines3 months agoEx-NIWA boss, Oyebamiji, emerges most media-friendly CEO in maritime industry

-

Headlines4 days ago

Headlines4 days agoFIFA sends Nigeria’s Super Eagles to 2026 World Cup, awards boardroom scoreline of 3 goals to nil against DR Congo

-

Headlines3 months ago

Headlines3 months agoMARAN pulls industry’s stakeholders to unveil its iconic book on Maritime industry.

-

Customs3 months ago

Customs3 months agoHow Comptroller Adenuga is raising revenue profile of Seme command, facilitating regional trade.

-

Headlines3 months ago

Headlines3 months agoNigeria showcases readiness for compliance with IMO decarbonization policy at Brazil conference

-

Headlines3 months ago

Headlines3 months agoOndo govt inaugurates former NIMASA Director, Olu Aladenusi, as Special Aide on Marine and Blue Economy