Gloria Odion, Maritime Reporter

The Nigerian Maritime Administration and Safety Agency (NIMASA), has explained the simplified ways which interested indigenous ship owners could access the Cabotage Vessels Financing Fund(CVFF).

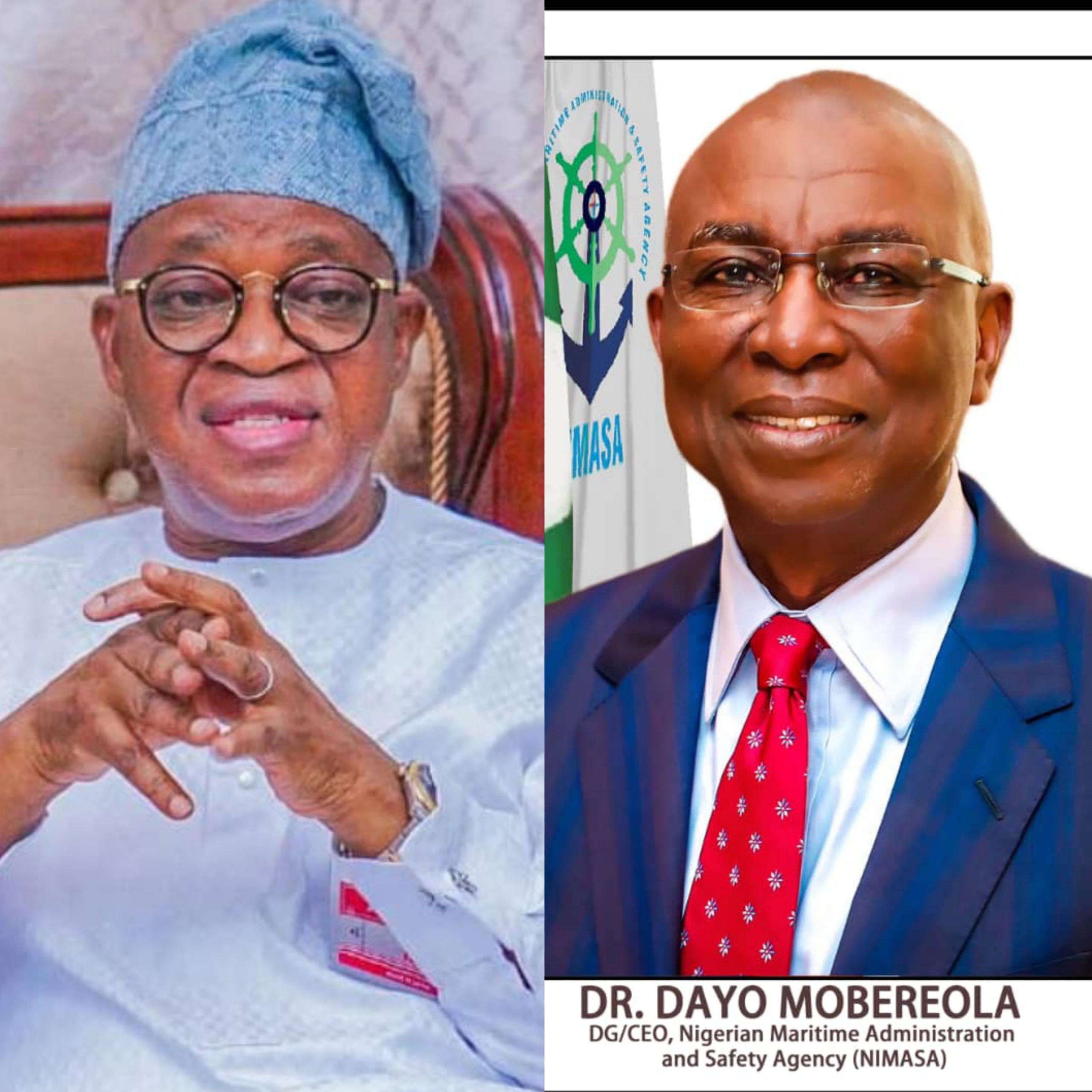

It could be recalled that the Minister of Marine and Blue Economy, Adegboyega Oyetola, recently launched the application portal for the disbursement of the fund.

In its public awareness campaign on the fund, NIMASA listed the terms and conditions of accessing the loans in a simplified manner.

Excerpts:

For decades, Nigeria ship owners contributed faithfully to the cabotage vessels financing.

A fund designed not as a subsidy but as a strategic instrument to build indigenous maritime capacity.

Today that promise enters a new phase not as an idea but as a process, clear, bankable, accountable, and sustainable the launch of the CVFF application portal max.

A shift from aspiration to execution.This is a significant step toward the final disbursement of the fund, which is aimed at growing Nigeria’s indigenous capacity in the maritime sector.

What follows is not merely access to funding but a disciplined pathway that align ship owners, bank, regulator and government under shared frame work of risk responsibility and reward.

STEP ONE : This is how the CVFF works

The process has been simplified.

The applicant from any part of the world only requires a smartphone or a computer to log on the CVFF application portal where they register and submit an application with any of the pre- qualified primary lending institution.

The PLI: First bank, Zenith bank,Lotus bank, Stanbic bank,Jais bank, UBA, Optimus bank, Fidelity Bank, Sun Trust, Taj bank and Bank of industry.

These banks were selected after a thorough selection process that involved advertisement expression of interest and appointment as a PLI to the fund.

*The applicants must present a bankable feasibility

*Contribute minimus equity of 15 percent of the credit facility required.

*They must demonstrate managerial competence in operational capacity.

*Provide acceptable collateral and any other requirements as the CVFF may demand.

In short, this is capital operators who are ready.

STEP 2

The primary lending institution (PLI) conducts its own preview under internal processes and timelines.

The PLI commits at least 15 percent of the facility while NIMASA participation is up to 70 percent capped at 25 million dollars or its equivalent in the approved currency.

Crucially, the credit risk rests squarely with the banks.

This is not interventions lending, it is structured finance.

A formal terms sheet is issued, the transaction takes place.

STEP 3

At the CVFF secretarial supported by the appointed advisor, NIMASA conducts due diligence and eligibility review.

Where the application qualifies, NIMASA issues a certificate of eligibility.

Transparency is not optional, it is foundational.

STEP 4

With eligibility confirmed, NIMASA proceeds through internal executives approval and approval of the Honorable Minister of Marine and Blue Economy to consummate the transaction.

After the ministerial approval is obtained, NIMASA informs PLI and a substantive offer letter is issued to the applicant to enable it commence activities towards meeting stated terms and conditions.

This would be carried out under the close supervision of the PLIs AND NIMASA.

STEP 5

Fund disbursement upon fulfillment of all conditions precedent, legal, financial and operational, the PLI notifies NIMASA to transmit funds for onward utilization.

Funds are disbursed to the PLIs by NIMASA through a specialized process within 72 hours of receipt of a duly authorized disbursement request from the PLIs.

The facility is deployed strictly under agreed terms.

STEP6

The facility is utilized in line with transaction purpose, repayment commences.

*Interest income is remitted to the cabotage vessels financing fund (CVFF).

*Regular monitoring, performance updates and reporting continuous.

The system is active where obligations are met.

The facility runs it’s full tenor , where challenge arises, recovery rests with the PLIs with NIMASA full institutional support.

At maturity, the applicant is formally discharged and the transaction is closed, capacity has been created.

This is the CVFF, not as promise but as process.

Reward preparedness, discipline and partnership. And the portal that opens the door to those ready to sail through it.

Headlines3 months ago

Headlines3 months ago

Headlines4 days ago

Headlines4 days ago

Headlines3 months ago

Headlines3 months ago

Customs3 months ago

Customs3 months ago

Headlines3 months ago

Headlines3 months ago

Headlines3 months ago

Headlines3 months ago