Headlines

NIMASA reads riot act to banks over disbursement of CVFF

However, NIMASA DG disclosed that the agency had given the disbursing institutions 72 hours to come up with harmonised position on the modalities for disbursement of the dollar component of the funds which is put at $350 million.

According to him, the banks are expected to come up with issues such as the interest rate, tenor, collateral, and other requirements needed to access the fund.

According to him, the interest rate must be of international best practices because the money to be released to the banks is in foreign currencies and not local currency.He, however, stated further that the disbursement of CVFF can’t start without stakeholders’ engagement, saying that was why the agency met with PLIs.

“We can’t start disbursement without stakeholders’ engagement, therefore, stakeholders’ engagement starts today(Tuesday)

” We are on track, we have started with the PLIs and all five of them are here today. We have listened to them and they listened to us and from all indications, they are ready for us as well.”

“What we want them to do now is to allow them to come up with a collective decision and that cannot take more than 72 hours.

” This is what we advised them to do and as soon as they finish that, we will then invite the shipowners,” he said.

When asked what the interest rate and the collaterals needed by shipowners to access the loans are, he said the guidelines will disclose that.

“The guidelines will tell us the interest rate and how the interest rate is supposed to be, the tenor, and the collateral because we won’t allow them to come and make the shipowners feel very insecure.”

“I mentioned to them on the issue of collateral, you all have NIMASA money with you, so all these things will be deliberated among themselves, let’s allow them to go through our guidelines seriously and see how they can adjust within themselves because we are giving them international currency, not Nigerian currency, they cannot start looking at Nigeria lending rate but the uniform international best practices so we are still on track because the guidelines stipulated everything, “he said.

“We will try our best to partner with the beneficiaries or the proposed beneficiaries of these funds and I believe they are much aware that this is not a grant, this is not money that they will just take away, this is money that is meant for a purpose and we will ensure that that purpose is achieved to the benefits of the country.”

Headlines

NIWA partners ICPC to strengthen internal transparency in its operations

Headlines

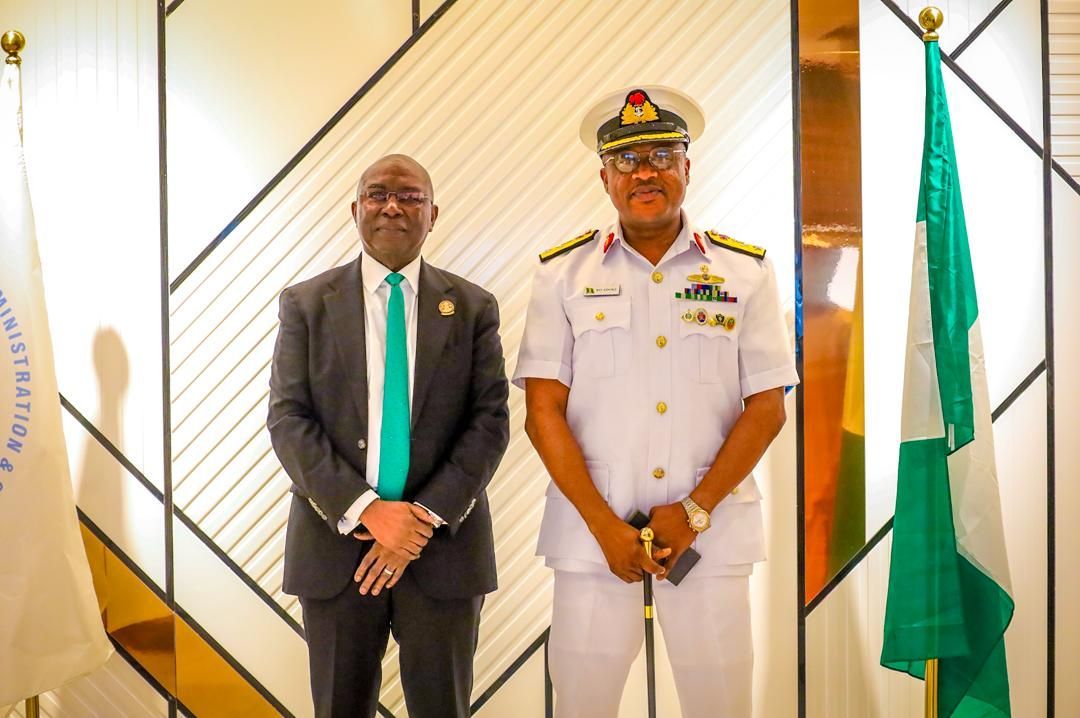

Navy appoints new Maritime Guard Commander for NIMASA

Commodore Adoki, a principal Warfare Officer specializing in communication and intelligence, brings onboard 25 years experience in the Nigerian Navy covering training, staff and operations.

Welcoming the new MGC Commander to the Agency, the Director General, Dr Dayo Mobereola, expressed confidence in Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA strengthen operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

Customs

Customs collects N1.585 trillion from 51 compliant traders under AEO programme

-

Headlines3 months ago

Headlines3 months agoEx-NIWA boss, Oyebamiji, emerges most media-friendly CEO in maritime industry

-

Headlines4 days ago

Headlines4 days agoFIFA sends Nigeria’s Super Eagles to 2026 World Cup, awards boardroom scoreline of 3 goals to nil against DR Congo

-

Headlines3 months ago

Headlines3 months agoMARAN pulls industry’s stakeholders to unveil its iconic book on Maritime industry.

-

Customs3 months ago

Customs3 months agoHow Comptroller Adenuga is raising revenue profile of Seme command, facilitating regional trade.

-

Headlines3 months ago

Headlines3 months agoNigeria showcases readiness for compliance with IMO decarbonization policy at Brazil conference

-

Headlines3 months ago

Headlines3 months agoOndo govt inaugurates former NIMASA Director, Olu Aladenusi, as Special Aide on Marine and Blue Economy