Headlines

Audit report exposes Customs, NNPC under- remittance to Federation account.

The 2019 Auditor- General’s Federation Annual Report has shown that the country may have been shortchanged to the tune of N666.15 billion due to the discrepancies observed in the financial books of the Nigerian National Petroleum Corporation (NNPC) and Nigeria Customs Service (NCS).

In compliance with the provisions of the 1999 constitution of the Federal Republic of Nigeria, on August 18, 2021, the Auditor-General for the Federation, Aghughu Adolphus, submitted to the Clerk of the National Assembly the Annual Report on the Federal Government of Nigeria Consolidated Financial Statements (CFS) for the year ended 31st December 2019.

A review of the Audit report revealed that some of the figures, particularly those of the NNPC and NCS did not tally.

On page 50 of its 2019 Annual Reports and Financial Statements, the NNPC-National Petroleum Investment Management Services (NAPIMS) reported that it transferred the sum of N1.27 trillion to the Federation Account

However, in the 2019 Audit report, the Accountant-General of the Federation (AGF) who is the Chief Accounting Officer for the receipts and payments of account of the federation, noted in his records submitted for audit that only N608.71 billion was received as a remittance by NNPC into the Federation Account for 2019.

This shows a difference of N663.90 billion, between the figure NNPC-NAPIMS reported in its audited financial statements and the amount the AGF claimed the NNPC transferred into the Federation Account as remittance for 2019.

Similar discrepancies were noted in the financial books of the Nigeria Customs Service.

As noted in the Auditor’s report, the NCS generated revenue of N841.27 billion in 2019. This exact amount was supposed to be remitted by NCS to the Federation Account.

However, only the sum of N839.02 was remitted to the Federation Account through the Nigerian Integrated Customs Information System II (NICIS II), indicating that the total money remitted fell short by N2.26 billion.

If the NCS’s N2.26 billion variance is added up with the N663.90 billion shortfall observed in the financial statements of NNPC and AGF’s record, it brings the total figure to N666.15 billion.

As the Auditor General noted in the report, these discrepancies mean a loss of revenue to the government and could lead to difficulty in funding the (2019) budget.

True to the worries expressed by the Auditor-General in the 2019 Audit report, it was actually difficult for the government to fund its 2019 budget as the government resorted to borrowing.

In December 2018, President Buhari presented to a joint session of the National Assembly a proposed budget of N8.83 trillion for the 2019 fiscal year.

In his budget presentation, the President noted that the 2019 budget had a projected deficit of N1.86 trillion which was to be financed by borrowing.

The country’s Finance Minister, Zainab Ahmed stated clearly that, “we (the government) intend to fund the 2019 budget through borrowing locally and internationally with a spread of 50:50”, indicating that the government lacked the necessary revenue to fund its budget for that year.

The 2019 budget was not the first the government-financed through borrowed funds.

However, if the N666.15 billion arising from the differences in the financial records provided by the NNPC and AGF, as well as that of the NCS had been fully remitted to the Federation Account as the Audit report showed, it could have potentially reduced the amount the government borrowed to fund the 2019 budget by 35.71%.

This could have also reduced the country’s debt burden which currently stands at N35 trillion and is projected to rise to the tune of at least N41 trillion before the end of 2022.

While the government continues to devise ways to tackle the problem of revenue shortages that have made it difficult to fund its annual budgets, economic experts advised that the Federal Government should follow the recommendations of the Auditor General by ensuring that the management of the NNPC provide reasons for the discrepancy between what it reported in its NNPC-NAPIMS audited financial statements and the figure reported by the AGF as NNPC-NAPIMS remittance into the Federation Account for 2019.

Headlines

NIWA partners ICPC to strengthen internal transparency in its operations

Headlines

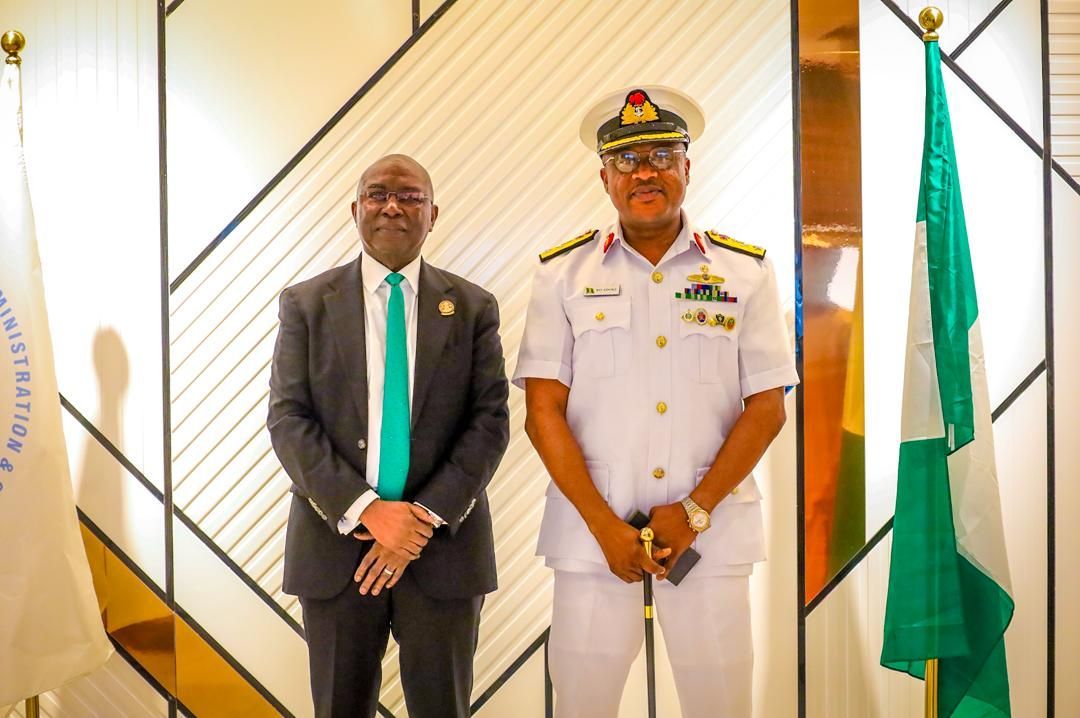

Navy appoints new Maritime Guard Commander for NIMASA

Commodore Adoki, a principal Warfare Officer specializing in communication and intelligence, brings onboard 25 years experience in the Nigerian Navy covering training, staff and operations.

Welcoming the new MGC Commander to the Agency, the Director General, Dr Dayo Mobereola, expressed confidence in Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA strengthen operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

Customs

Customs collects N1.585 trillion from 51 compliant traders under AEO programme

-

Headlines3 months ago

Headlines3 months agoEx-NIWA boss, Oyebamiji, emerges most media-friendly CEO in maritime industry

-

Headlines4 days ago

Headlines4 days agoFIFA sends Nigeria’s Super Eagles to 2026 World Cup, awards boardroom scoreline of 3 goals to nil against DR Congo

-

Headlines3 months ago

Headlines3 months agoMARAN pulls industry’s stakeholders to unveil its iconic book on Maritime industry.

-

Customs3 months ago

Customs3 months agoHow Comptroller Adenuga is raising revenue profile of Seme command, facilitating regional trade.

-

Headlines3 months ago

Headlines3 months agoNigeria showcases readiness for compliance with IMO decarbonization policy at Brazil conference

-

Headlines3 months ago

Headlines3 months agoOndo govt inaugurates former NIMASA Director, Olu Aladenusi, as Special Aide on Marine and Blue Economy