Customs

Customs, CBN clash over e- valuation, e-invoice policy

The Nigeria Customs Service (NCS) and the Central Bank of Nigeria (CBN) have expressed divergent views over the introduction of e-valuation, e-invoice policy for import and export introduced by the apex bank.

The CBN explained that the new policy would block leakages and generate more revenue for the government.

In their submission, the Manufacturers Association of Nigeria (MAN) said the apex bank was too hasty in implementing the policy without inputs from relevant stakeholders.

The CBN had issued a circular that the new system would kick off on February 1, 2022, but the House had on January 27, 2022, suspended it and directed the apex bank to adopt a 90-day timeline for the implementation of fiscal measures to avoid destabilising effects on the economy.

Director, Trade and Exchange, Dr. Ozoemena Nnaji, who represented the CBN, said the new system was seamless and integrated with the import and export process in a manner that does not hamper any of the stakeholders.

“This would be one way of ensuring what we should earn in trade comes to us without loss of foreign and duties.

She also revealed that an analysis of trade invoicing in Nigeria in 2014, shows that the potential loss of revenue to the government was approximately 2.2 billion for the year.

This amount, she says, represents four percent of total annual government revenue (as reported by the IMF), and fifteen percent (approximately) of the country’s total trade.

On his part, the Assistant Comptroller-General of the Customs Service, Galadima Saidu, said the new CBN policy was in violation of the World Trade Organisation’s Facilitation Agreement (WTO TFA) of which Nigeria is a signatory.

“The introduction of the CBN initiative is against Article 7 of General Agreement on tariff and trade 1994 and Article 1, 2 and 6 of the WTO TFA. The agreement aims for a fair, uniform, and neutral system for the valuation of goods for Customs purpose and it conforms to commercial realities and which outlaws the use of arbitrary or fictitious customs values.

Nigeria is a signatory to the WTO trade facilitation agreement. The agreement is legally binding with punitive measures that would adversely affect the Nigerian economy.”

He added that WTO agreement emphasises the need for a timeframe for the publication of any additional fees or charges, hence the CBN’s circular introducing the policy dated 21st January 2022, with an effective date of 1st February 2022 violated this.

He further pointed out that the use of bench-marking in valuation would negate the aim of the agreement on Customs valuation and would result in delays and uncertainties.

“The use of bench-marking in valuation would negate the aim of our agreement on Customs valuation and would result in delays and uncertainties. The use of benchmarking in valuation was abolished due to the dynamic nature of pricing, especially in this current time when technology is rapidly evolving,” he said.

Saidu claimed that the Customs Service was only informed through newspaper publications about the introduction of the policy and effective date of the CBN initiative, as there was no consultation done prior to the release to the public.

He also said the window which is just 10 days apart, is too short and would disrupt the trade supply chain and revenue collection

“The introduction of additional fees and or charges and procedures though the e-evaluating and e-invoicing would definitely set back Nigerian traders and adversely affect Nigerian economy which has struggled to recover from two recessions in the past five years.

It would not be in the best interest of CBN, NCS, or the Nigerian Government to proceed with any initiative that would hinder Nigerian traders from being able to compete in these trying times,” he said.

Earlier, the representative of MAN, Folurunsho Adeyemi, said there is a need to ensure the CBN doesn’t go ahead with implementing the policy without accommodating constructive inputs of stakeholders, especially those whose businesses would be negatively impacted.

This, he said, is necessary to ensure the government does not create a regime of chaos that would decelerate the already low level of activity in the economy.

The Joint Committee Chairman, Leke Abejide (ADC, Kogi), in his ruling directed the CBN and Customs Service to harmonise their differing opinions on the import/export electronic invoice policy and report back on March 17, 2022, for further action.

He also said the policy remains suspended until they report back and conclude on the matter.

|

ReplyForward

|

Customs

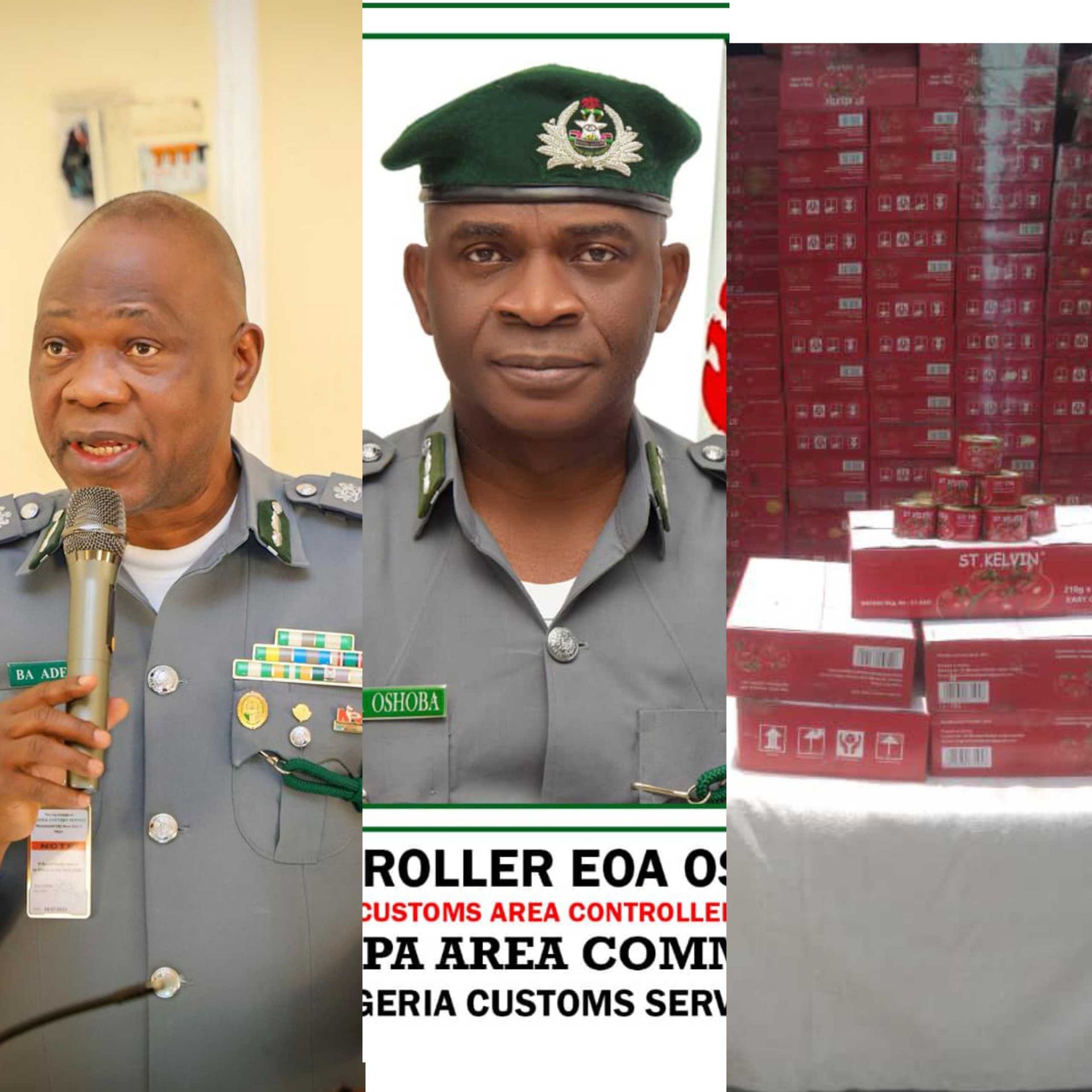

Apapa Customs records major breakthrough in anti- smuggling operations.

Customs

Dera Nnadi bows out of Customs in a blaze of glory

Customs

Customs takes charge of implementation of National Single Window project

-

Headlines3 weeks ago

Headlines3 weeks agoFIFA sends Nigeria’s Super Eagles to 2026 World Cup, awards boardroom scoreline of 3 goals to nil against DR Congo

-

Headlines2 months ago

Headlines2 months agoAyobo residents protest deplorable road at LCDA, complain of 10- year neglect by successive local council administrations.

-

Headlines3 months ago

Headlines3 months agoFG approves 50 percent price slash on Yuletide train services

-

Customs2 months ago

Customs2 months agoApapa Customs stretches illicit drug seizures streak with another new year interdiction of 30.1 kg of cocaine on board vessel.

-

Headlines3 months ago

Headlines3 months agoFG trains 75 boat operators on safe inland waterway navigation

-

Customs2 months ago

Customs2 months agoTinubu pays glowing tribute to Adeniyi, CGC, at 60